Crafting a Cover Letter for Insurance Adjuster Positions

A well-crafted cover letter is your first introduction to a potential employer and can significantly influence your chances of landing an interview as an insurance adjuster. This document should go beyond simply restating your resume; it’s an opportunity to showcase your personality, express your enthusiasm for the role, and highlight the specific skills and experiences that make you a strong candidate. Remember that an insurance adjuster position demands a keen eye for detail, strong analytical abilities, and the capacity to communicate effectively with various stakeholders. Therefore, your cover letter should demonstrate these qualities through clear, concise, and professional writing.

Highlighting Relevant Skills and Experience

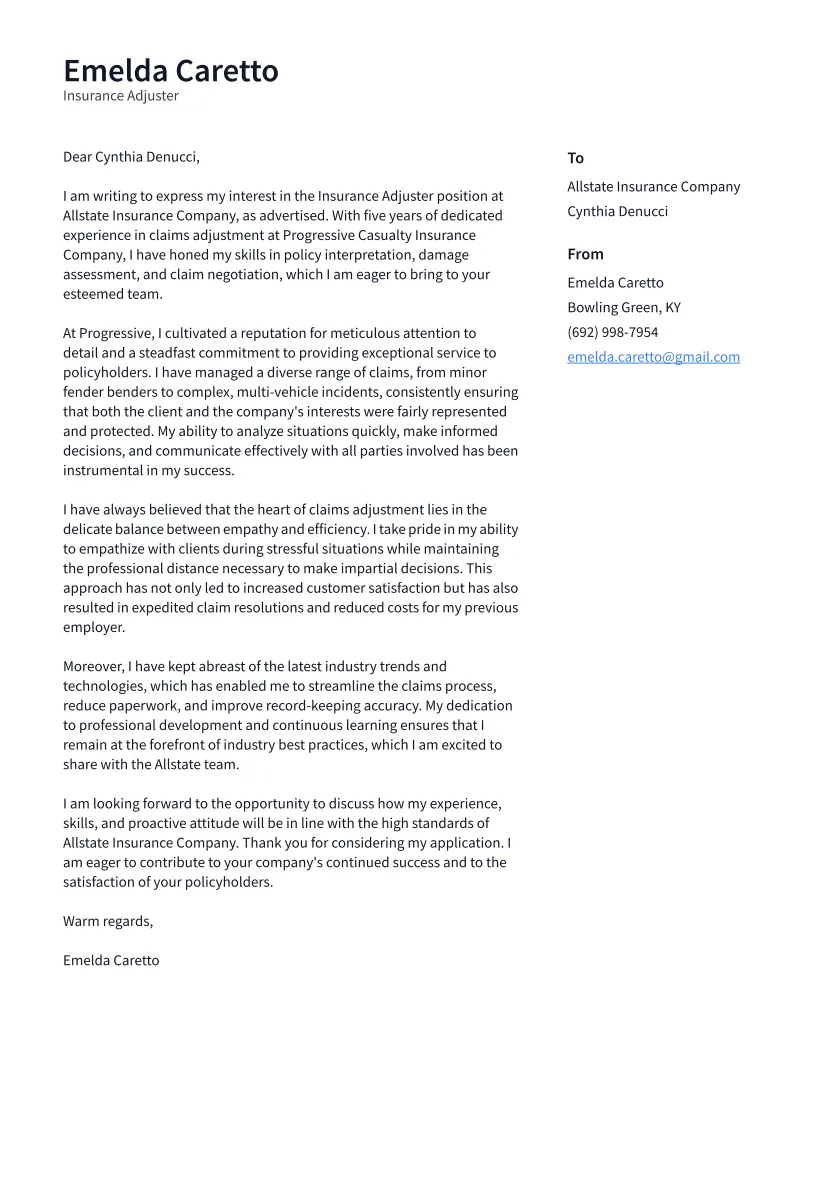

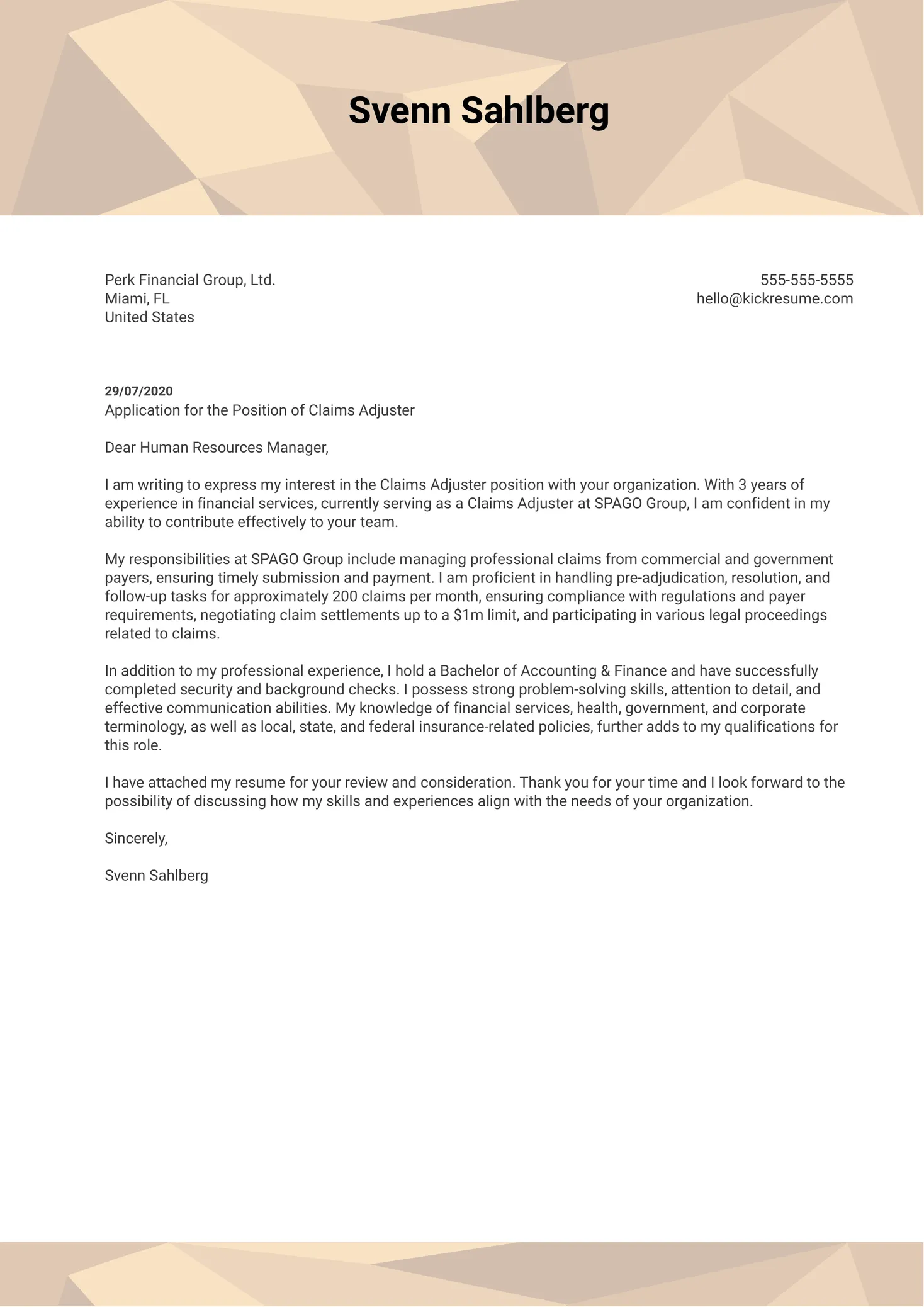

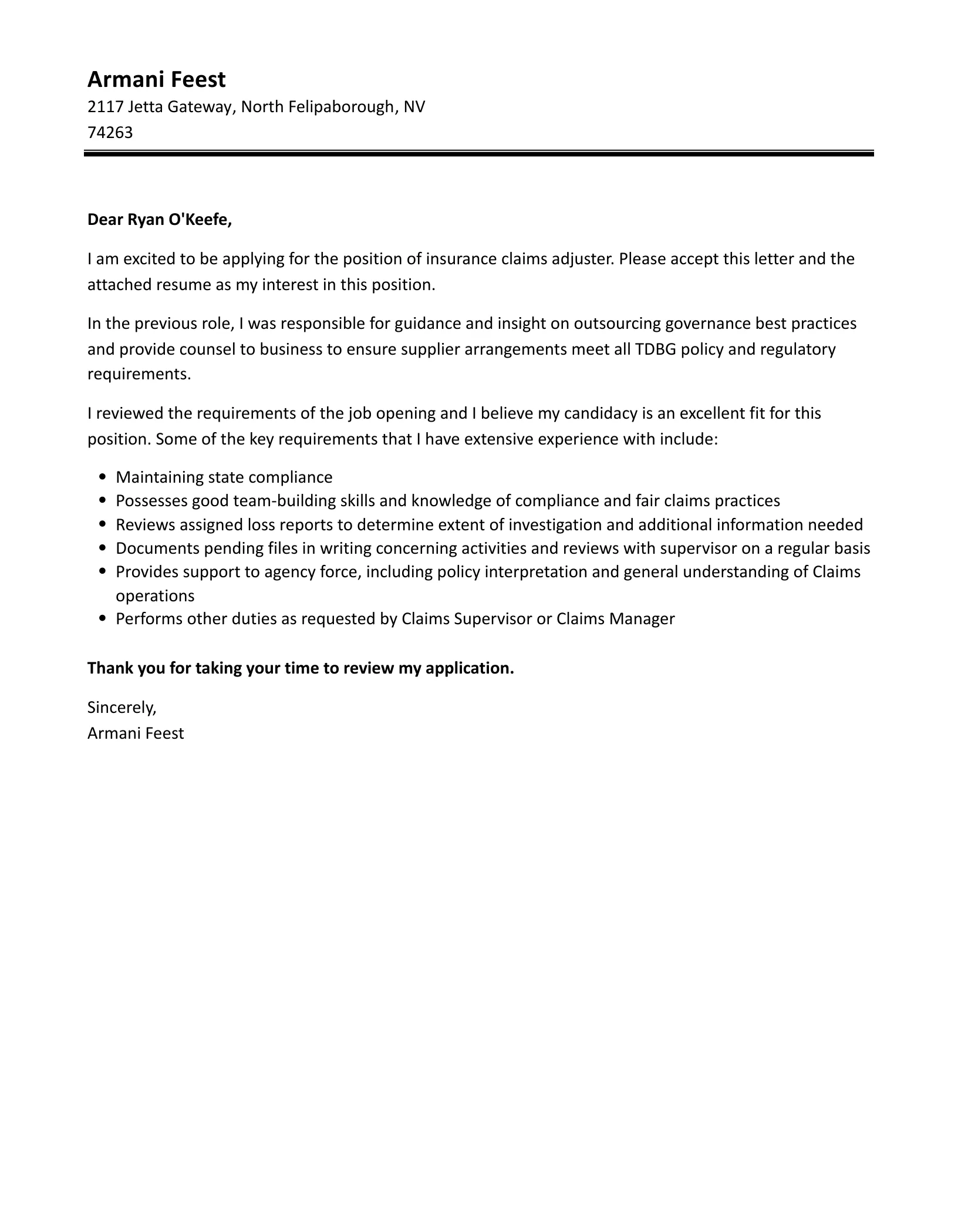

When you’re applying for an insurance adjuster position, it’s essential to spotlight the skills and experiences most pertinent to the job. Start by reviewing the job description carefully to identify the key requirements. Then, in your cover letter, provide concrete examples of how you’ve demonstrated these skills in previous roles or situations. For example, if the job requires experience in claims investigation, describe a time when you successfully investigated a claim, highlighting the steps you took, the challenges you overcame, and the positive outcome you achieved. Similarly, showcase your expertise in areas such as policy interpretation, negotiation, and customer service. Remember to use action verbs to describe your accomplishments, such as “managed,” “analyzed,” “resolved,” and “negotiated.”

Quantifying Achievements and Results

To make your cover letter truly impactful, focus on quantifying your achievements whenever possible. Instead of just stating that you “improved customer satisfaction,” provide specific numbers, such as “increased customer satisfaction scores by 15% within six months.” Similarly, if you were responsible for reducing claims processing time, indicate the percentage or amount of time you saved. Quantifiable results provide potential employers with concrete evidence of your capabilities and the value you can bring to their organization. This approach sets you apart from other applicants and demonstrates your ability to deliver tangible results in the role of an insurance adjuster.

Tailoring the Letter to the Job Description

Avoid using a generic cover letter. Instead, customize each letter to the specific job description and the company you’re applying to. Review the job description carefully and identify the key requirements and desired qualifications. Then, in your cover letter, address these points directly, providing examples of how your skills and experiences align with the employer’s needs. Research the company to understand its values, culture, and mission. Use this information to tailor your letter, showing that you’ve taken the time to learn about the organization and are genuinely interested in the position. This personalization demonstrates your attention to detail and your genuine interest in the opportunity. Always adapt your tone and style based on the organization’s communication style.

Showcasing Knowledge of Insurance Principles

An effective cover letter for an insurance adjuster position should highlight your understanding of insurance principles. Briefly mention your familiarity with insurance policies, coverage types, and claims processes. If you have relevant certifications or training, such as an Associate in Claims (AIC) designation, be sure to include them. Furthermore, demonstrate your knowledge of relevant regulations and industry best practices. This shows potential employers that you possess the foundational knowledge required to succeed in the role and that you’re committed to upholding the highest standards of professionalism and ethical conduct.

Demonstrating Strong Communication Skills

As an insurance adjuster, effective communication is paramount. Your cover letter should serve as an example of your written communication skills. Use clear, concise language, and organize your thoughts logically. Avoid jargon or overly complex sentences that could confuse the reader. Showcase your ability to convey information accurately and professionally. In addition, highlight your ability to communicate effectively with various stakeholders, including policyholders, claimants, and insurance company representatives. Mention any experience you have in negotiation, conflict resolution, or providing excellent customer service. These skills are essential for success in this field, and demonstrating them in your cover letter will significantly improve your chances of getting hired.

Emphasizing Attention to Detail

Insurance adjusting demands meticulous attention to detail. Your cover letter should reflect this. Proofread carefully for any grammatical errors or typos. Ensure that all information is accurate and complete. Demonstrate your ability to follow instructions and adhere to deadlines. You might include details regarding your process of reviewing documents and identifying critical information. Consider mentioning any systems or tools you have used to maintain organization and accuracy. Your cover letter is a chance to show that you’re not only capable but also committed to performing your work with precision and care. This attention to detail is crucial for building trust and maintaining a positive reputation within the industry.

Including a Compelling Call to Action

Conclude your cover letter with a strong call to action. Express your enthusiasm for the position and reiterate your interest in the company. Request an interview, and provide your contact information clearly and concisely. Make it easy for the employer to reach you. Thank the hiring manager for their time and consideration. If possible, mention how you plan to follow up. A well-crafted call to action leaves a lasting positive impression and increases your chances of being contacted for an interview. This final touch can make a huge difference in the outcome of your job application. Remember that you are selling yourself, so make sure you communicate your value proposition effectively.

Proofreading and Formatting the Cover Letter

The overall presentation of your cover letter is as important as its content. A poorly formatted and error-riddled letter can undermine your qualifications and give the impression that you are not detail-oriented. To avoid these pitfalls, proofread your cover letter multiple times, paying close attention to grammar, spelling, and punctuation. Consider asking a friend or family member to review your letter for a second opinion. Choose a professional and easy-to-read font, such as Times New Roman, Arial, or Calibri. Use a clear and consistent format, with appropriate margins and spacing. Make sure your contact information is correct and up-to-date. A well-formatted cover letter demonstrates your professionalism and enhances your chances of making a positive impression.

Ensuring Clarity and Conciseness

When composing your cover letter, strive for clarity and conciseness. Get straight to the point and avoid using overly complex language or jargon. Use short, easy-to-understand sentences and paragraphs. Keep your letter to one page in length, as hiring managers often have limited time to review applications. Focus on conveying your message in a clear and efficient manner. Highlight your most relevant skills and experiences without unnecessary embellishment. Remember, the goal is to quickly and effectively demonstrate that you are a strong candidate for the position.

Using Professional Language and Tone

Maintain a professional tone throughout your cover letter. Use formal language and avoid slang, idioms, or casual expressions. Show respect for the hiring manager and the company by addressing them appropriately. Avoid being overly familiar or informal. Be positive, enthusiastic, and confident, but avoid making exaggerated claims or sounding arrogant. Your cover letter should showcase your personality and passion while remaining professional and businesslike. Reviewing the company’s culture and values can guide your approach. Professional language and tone demonstrate respect and make a positive impression.

Checking for Grammatical Errors and Typos

Nothing can damage your credibility more quickly than grammatical errors and typos. These mistakes detract from the overall professionalism of your cover letter and can lead a hiring manager to question your attention to detail. Before submitting your application, carefully proofread your cover letter multiple times. Use a grammar and spell-checking tool, but don’t rely on it entirely; these tools can sometimes miss errors. Read your cover letter aloud to catch any awkward phrasing or inconsistencies. Ask someone else to review your letter and provide feedback. Investing the time to ensure your cover letter is free of errors is an investment in your future.