What is an Investor Cover Letter

An investor cover letter is a crucial document for any business seeking funding. It serves as a formal introduction, providing potential investors with a concise overview of your company, its mission, and the investment opportunity. Essentially, it’s your first chance to make a strong impression and persuade investors to delve deeper into your business plan and consider providing financial backing. A well-crafted cover letter can be the difference between securing a meeting and being overlooked. It distills the essence of your value proposition, making it easy for busy investors to quickly grasp your company’s potential and why they should invest in it. It should be considered a succinct and compelling snapshot of your business.

Key Components of a Winning Investor Cover Letter

A winning investor cover letter must include several key components to effectively convey your business’s potential and attract investment. These elements work together to create a persuasive narrative that captures the investor’s attention and encourages them to learn more. Each section plays a specific role in building a compelling case for investment, and their integration is what separates a good cover letter from a great one. Remember that this letter is a conversation starter – it’s about laying the groundwork for a deeper discussion and, ultimately, securing funding. Ensure you cover all these elements thoroughly to present a comprehensive and persuasive case.

Company Overview

Begin with a brief, yet compelling overview of your company. What does your company do? What is its mission? Provide a clear statement of your business’s purpose and value proposition. Concisely describe the product or service you offer and the target market you serve. Emphasize what makes your company unique. Include key details such as the company’s founding date, current stage (startup, established business), and the core team’s experience. This section sets the stage, giving investors a quick understanding of your company’s identity and its position in the market. Highlight your company’s key strengths and any significant achievements that demonstrate its potential for growth.

Problem and Solution

Identify the problem your business solves. What market need does your product or service address? Clearly articulate the pain points or challenges your target customers face. Then, explain how your business provides the solution. Detail how your product or service addresses the identified problem, offering a compelling value proposition. This section is crucial for demonstrating the relevance and necessity of your business. Illustrate how your solution is superior to existing alternatives. Back up your claims with evidence, such as customer testimonials, market research, or any data that validates your solution’s effectiveness.

Market Opportunity

Provide a concise summary of the market your business operates in. What is the size of the market, and what is its growth potential? Demonstrate the market’s attractiveness and its potential for expansion. Highlight trends and factors that favor your business’s success. Back up your claims with industry reports, market research data, and any statistics that showcase the market opportunity. This section shows investors that there is a significant demand for your product or service and that the market is ripe for growth. Showcasing the opportunity will enhance the appeal of your investment proposition.

Financial Projections

Include key financial projections to demonstrate your business’s potential profitability and scalability. Provide an overview of your revenue forecasts, detailing your projected sales and income over a specific period. Showcase your projected expenses, including operating costs, marketing expenses, and other relevant financial data. Include key financial metrics like the gross margin and the anticipated profit margin. This section needs to build investor confidence in the financial viability of your business. Highlight your understanding of financial planning and your ability to manage the business responsibly. Be realistic in your projections and back them up with market data and sales plans.

Investment Highlights

Specify the amount of funding you are seeking and how it will be used. What specific projects or initiatives will the investment support? Explain the terms of the investment, including equity offered, the proposed valuation of your business, and any other relevant details. Briefly describe the anticipated return on investment (ROI) for investors. Show investors the benefits of investing in your business. Investors want to understand the terms of the investment and the potential benefits. By providing the specific details, you demonstrate that you’ve planned for how the investment will be used. The investment highlights are essential for clarifying the investment specifics.

How to Structure Your Investor Cover Letter

Structuring your investor cover letter properly ensures it is easy to read and captures the investor’s attention from the start. The structure is just as important as the content. A well-organized letter showcases professionalism and attention to detail. A clear and logical structure helps investors quickly grasp the essential information, making it more likely that they will engage with your proposal. Each section should flow logically into the next, creating a cohesive narrative that builds your case for investment. Structuring your letter correctly will greatly improve your chances of success.

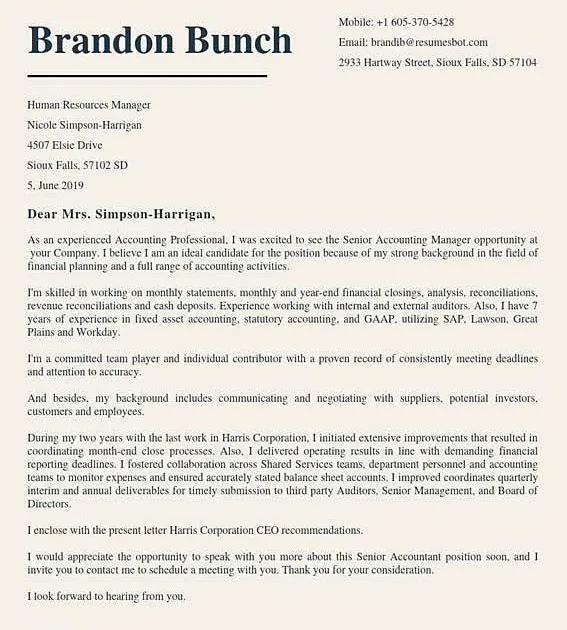

Crafting a Compelling Opening

Start with a strong and engaging opening that immediately grabs the investor’s attention. Introduce yourself and your company in a concise and compelling manner. State the purpose of the letter clearly and assertively, highlighting the investment opportunity. Consider mentioning a mutual connection or a reference to build rapport. This first paragraph sets the tone for the entire letter and encourages the reader to continue. A well-crafted opening is crucial for capturing the investor’s interest and making them want to read further. The opening paragraph serves as a critical hook, encouraging the reader to continue.

Providing a Concise Summary

Provide a brief overview of your business’s core aspects. Summarize your value proposition, highlighting key features, benefits, and your target market. Include a quick overview of your market opportunity, emphasizing its size, growth potential, and any relevant market trends. Briefly state your investment needs, specifying the amount of funding you are seeking and how you intend to use it. A concise summary helps the investor quickly understand the main points of your proposal without getting lost in details. It’s the elevator pitch of your cover letter. The summary should be impactful and demonstrate your understanding of the business.

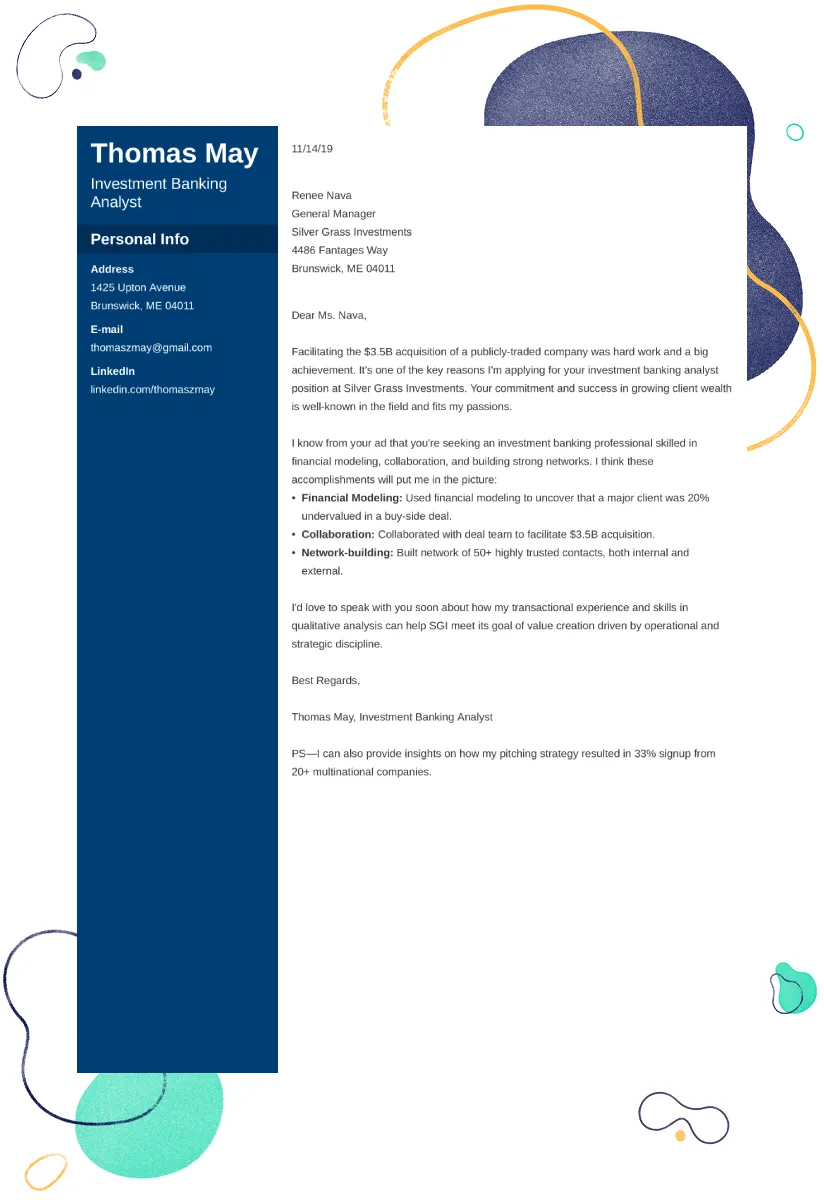

Highlighting Key Achievements

Focus on key achievements that demonstrate the success and potential of your business. Mention milestones achieved, such as product launches, customer acquisition, or significant partnerships. Include relevant data, such as revenue growth, market share gains, and other notable metrics. Quantify your achievements whenever possible, as numbers are often more impactful. Highlighting achievements builds credibility and gives investors confidence. Choose achievements that are most relevant to the investment opportunity and show your business is well-positioned for growth. Focusing on your achievements helps to showcase your business’s capabilities and accomplishments.

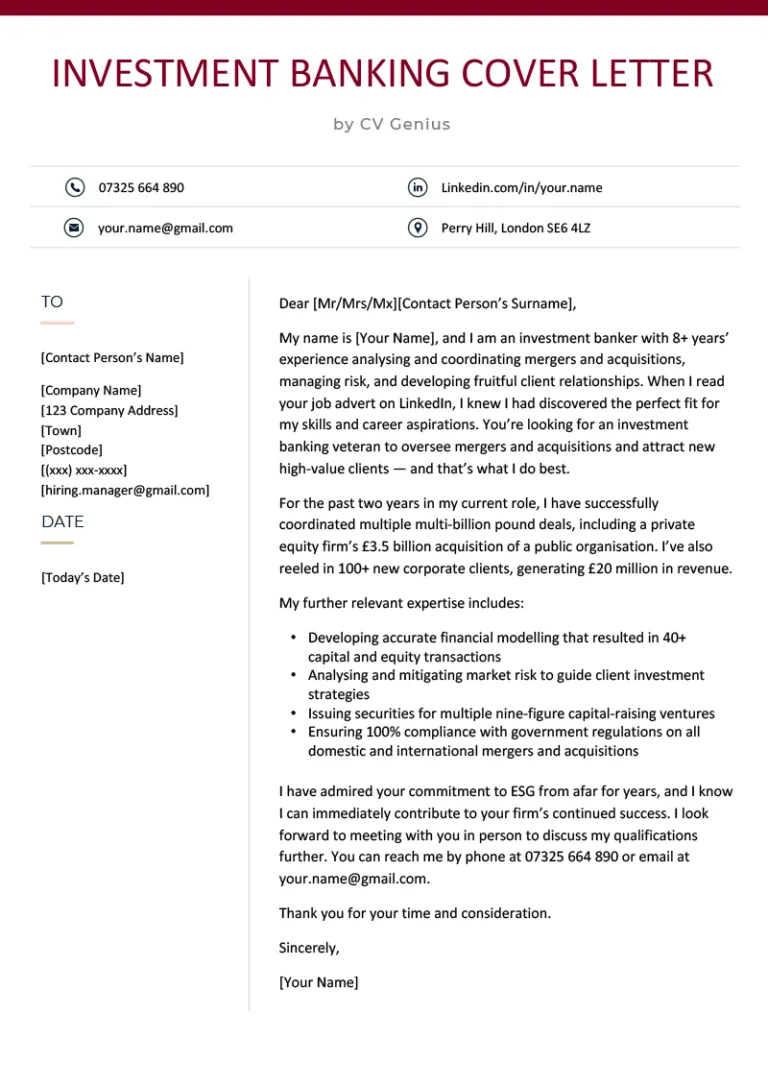

Clearly Stating Your Ask

Clearly and explicitly state the amount of funding you are seeking from the investor. Specify the terms of the investment, including the equity offered, the proposed valuation of your business, and any other relevant financial details. Explain how the funds will be used to support your business’s growth and achieve your goals. Provide a clear call to action, indicating how the investor can proceed if they are interested. Clearly stating your ask demonstrates professionalism and ensures the investor knows exactly what you are looking for. Make it as easy as possible for the investor to consider your offer and take the next steps. Ensure clarity and confidence in the ask.

Formatting and Design Tips

Proper formatting and design are crucial for making your investor cover letter visually appealing and easy to read. A well-formatted letter is more likely to capture the investor’s attention. Professional formatting enhances readability and underscores your attention to detail. Effective formatting makes your letter easier to navigate and digest. Following these tips can significantly improve the professionalism and impact of your investor cover letter.

Keep it Concise

Keep your cover letter concise and to the point, avoiding unnecessary jargon and lengthy explanations. Investors are busy and appreciate clear, straightforward information. Aim for one to two pages maximum. Ensure every sentence serves a purpose, conveying essential information efficiently. Use bullet points and short paragraphs to break up the text and improve readability. The goal is to provide all necessary information without overwhelming the investor. A concise cover letter reflects your respect for the investor’s time and presents your information in a more digestible format.

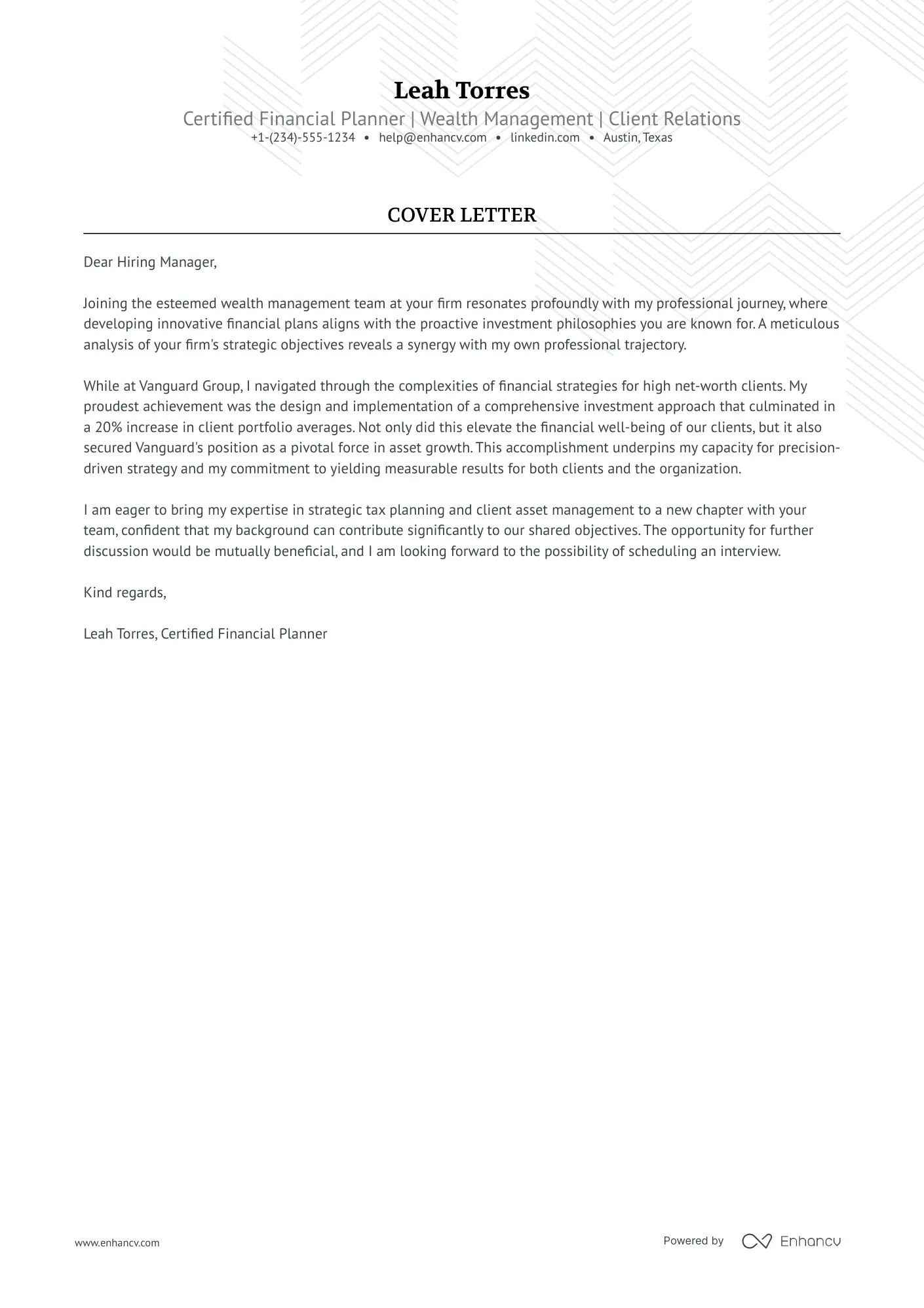

Use Professional Formatting

Use professional fonts, such as Arial or Times New Roman, to enhance readability. Maintain a consistent font size throughout the document. Use clear headings and subheadings to organize your content logically. Use bullet points and numbered lists to present information concisely. Choose a clean and professional design to enhance readability. Avoid clutter and use white space effectively to make the letter visually appealing and easy to read. Professional formatting shows you value detail and professionalism. It also makes your cover letter more readable.

Proofread Carefully

Proofread your cover letter thoroughly for any grammatical errors, spelling mistakes, or typos. Check the letter for consistency in formatting and style. Ensure all data and facts are accurate and properly presented. Have someone else review the letter to catch any mistakes you might have missed. Proofreading is essential for maintaining credibility and professionalism. Proofreading ensures that the investor has a good impression of your business.

Tips for Success

Maximize your chances of securing funding by following these success tips. These tips can significantly improve your chances of getting your cover letter to the investor. Combining them in the letter helps present a compelling case for investment. Follow these tips to make the most of the opportunity to attract investor interest.

Research Your Investors

Thoroughly research your target investors to understand their investment preferences, past investments, and areas of interest. Tailor your cover letter to align with their specific interests and investment criteria. Demonstrate that you have done your homework and understand their investment strategy. Understanding the investor’s background, industry focus, and investment history will help you. By demonstrating this research, you show you have thought about your investor.

Tailor Your Letter

Customize each cover letter to match the specific investor you are targeting. Address the investor by name and personalize your message to show that you value their attention. Highlight how your business aligns with their investment portfolio and interests. Tailoring your letter to each investor shows that you have put in the effort. Customizing your letter enhances its relevance and increases the likelihood of a positive response. The letter becomes much more compelling and relevant.

Follow Up Effectively

Send your cover letter promptly after your initial contact or meeting. After sending the cover letter, follow up with a phone call or email within a week or two to show your enthusiasm and interest. Be prepared to answer any questions the investor might have. Use follow-up communication as an opportunity to reiterate your key points and address any potential concerns. Effective follow-up shows your proactiveness and helps to keep your proposal at the top of the investor’s mind. Be persistent, but respectful of their time. This helps in strengthening relationships.