What is a Teller Cover Letter

A teller cover letter is a document you submit with your resume when applying for a teller position. It serves as a formal introduction, allowing you to showcase your qualifications, express your interest in the role, and demonstrate why you are a good fit for the bank or credit union. Even if you have no prior experience as a teller, a well-crafted cover letter can significantly improve your chances of getting an interview. It’s your opportunity to make a positive first impression and set yourself apart from other applicants. Remember, the cover letter is a critical part of the job application, and it complements your resume by providing context and a personalized touch.

Why is a Cover Letter Important

A cover letter is important because it allows you to communicate directly with the hiring manager and show them your personality. It’s a chance to personalize your application and highlight the aspects of your background that make you a great candidate. It explains any gaps in your resume or addresses the fact that you have no teller experience. It’s also your opportunity to demonstrate your writing skills, which are essential in any professional setting, and it helps showcase your communication abilities, which are vital for any teller position. A well-written cover letter demonstrates your attention to detail and your genuine interest in the specific bank or credit union and the teller role.

Key Components of a Teller Cover Letter

A strong teller cover letter consists of several key components. These elements work together to create a compelling and professional document that captures the hiring manager’s attention. Ensure you have the right information, and format the letter correctly to make a positive impact. Each section plays a crucial role in presenting you as a suitable candidate. Here’s a breakdown of the essential parts of a successful cover letter, from your contact information to the closing salutation.

Contact Information

At the top of your cover letter, provide your contact details. This includes your full name, address, phone number, and email address. Make sure the email address is professional-sounding. This information is essential for the hiring manager to contact you for an interview.

Hiring Manager’s Information

If possible, find the name of the hiring manager. Addressing the cover letter to a specific person shows that you’ve taken the time to research and personalize your application. If you can’t find a name, use a professional salutation such as “Dear Hiring Manager”.

Greeting and Opening

Start your cover letter with a formal greeting, such as “Dear Mr./Ms./Mx. [Last Name]” or “Dear Hiring Manager.” Then, in the opening paragraph, state the position you are applying for and how you learned about the opportunity. Express your enthusiasm for the role.

Expressing Enthusiasm for the Role

Show your genuine interest in the teller position and the specific bank or credit union. Explain why you are excited about the opportunity and what attracts you to the organization. This enthusiasm should shine through your words.

Highlighting Transferable Skills

Since you have no prior teller experience, focus on highlighting your transferable skills. These are the skills you’ve acquired in other roles or through your personal experiences that are relevant to the teller position. Focus on skills that will help you to be successful in this role.

Customer Service Skills

Emphasize your customer service skills, such as your ability to interact positively with people, resolve issues, and provide excellent service. Provide examples of how you’ve used these skills in the past. Being able to make customers happy is important.

Communication Skills

Showcase your strong communication skills, both written and verbal. Explain how you clearly communicate with others and actively listen to understand their needs. Being able to follow instructions and explain things in a simple way is key.

Attention to Detail

Stress your attention to detail and your ability to handle tasks accurately and efficiently. Provide instances where you’ve demonstrated these skills in other roles or activities. This is essential in handling money.

Adaptability and Learning Agility

Highlight your ability to adapt to new situations and your eagerness to learn new skills. This is important because you will be learning the specifics of the job and the company’s policies.

Addressing the Lack of Experience

Acknowledge the lack of teller experience directly but positively. Frame it as an opportunity to learn and grow within the company. Show you understand the role and are ready to quickly become proficient. Let them know you are ready to learn what is necessary to be successful.

Focus on Skills and Potential

Instead of dwelling on the lack of experience, shift the focus to your relevant skills and your potential to excel in the role. Emphasize your willingness to learn and your strong work ethic. Highlight what you can bring to the team.

Showcasing Relevant Experiences

Even without direct teller experience, you likely have experiences that demonstrate relevant skills. This could include previous customer service jobs, volunteer work, or even extracurricular activities. Try to find the commonalities that will make you a good teller.

Education and Training

If you have any relevant education or training, such as a degree in finance or business courses, mention it. Highlight any certifications or courses that demonstrate your interest in the field and prepare you for the role. If not, don’t worry, just explain why you would be a good fit.

Volunteer Work and Extracurricular Activities

Include volunteer work or extracurricular activities that showcase skills like teamwork, responsibility, and customer interaction. These experiences can provide valuable insights into your abilities, even without formal work experience. List anything that makes you well-rounded.

Formatting Your Cover Letter

The format of your cover letter is just as important as its content. A well-formatted letter is easy to read and demonstrates professionalism. Pay close attention to the layout, font, and overall appearance of your cover letter to make a positive impression on the hiring manager. Ensure your cover letter is visually appealing and easy to read, as it will make a great first impression.

Choosing the Right Font and Font Size

Use a professional and readable font, such as Times New Roman, Arial, or Calibri. Keep the font size between 10 and 12 points. This ensures your letter is easy on the eyes and avoids looking unprofessional. Use a standard font throughout the document.

Proper Grammar and Spelling

Proofread your cover letter carefully for any grammatical errors or spelling mistakes. Use a spell checker and grammar checker to help catch any errors. Errors can create a negative impression. Ask someone else to review your letter for a fresh perspective.

Cover Letter Structure

Structure your cover letter with clear paragraphs and a logical flow. Each paragraph should focus on a specific point and contribute to the overall message. Ensure your letter is well-organized and easy to follow. Make sure you include the key components discussed earlier.

First Paragraph

Start with a brief introduction stating the position you are applying for and how you learned about the opportunity. Express your enthusiasm for the role and the company.

Second Paragraph

Highlight your relevant skills and experiences, focusing on transferable abilities. Provide specific examples to demonstrate your qualifications. Focus on the skills that align with the teller position.

Third Paragraph

Address the lack of experience, if applicable, and reiterate your interest in the position. Mention your willingness to learn and grow within the company. Make a positive statement to emphasize your potential.

Closing the Cover Letter

End your cover letter with a professional closing, expressing your gratitude for the reader’s time and consideration. Reiterate your interest in the position and offer your availability for an interview. This demonstrates your professionalism and eagerness.

Expressing Gratitude and Offering Availability

Thank the hiring manager for considering your application and express your interest in an interview. State that you are available for an interview at their earliest convenience. Providing your availability shows your eagerness to move forward in the hiring process. Thank the hiring manager again for their time.

Proofreading and Editing

Before submitting your cover letter, proofread it carefully for any errors in grammar, spelling, or punctuation. It is very important to make a good impression. Read the cover letter out loud to catch any awkward phrasing or inconsistencies. Ask a friend or family member to review it as well.

Tips for Writing a Compelling Cover Letter

Follow these tips to make your cover letter stand out. Remember that a cover letter is the first impression you make on a potential employer. By following these tips, you can increase your chances of getting an interview.

Tailor Your Cover Letter

Customize your cover letter for each position you apply for. Research the specific requirements and responsibilities of the job and tailor your letter to highlight the most relevant skills and experiences. A generic cover letter is less likely to impress. Use keywords from the job description.

Research the Bank or Credit Union

Demonstrate that you’ve researched the bank or credit union and understand its values and mission. Mention specific reasons why you are interested in working for that particular institution. This shows your genuine interest and commitment.

Use Action Verbs

Use strong action verbs to describe your skills and accomplishments. This makes your cover letter more dynamic and engaging. Action verbs make your experience sound more impressive and they show you have been actively involved.

Highlight Accomplishments

Instead of simply listing your responsibilities, focus on your accomplishments and the results you achieved. Quantify your achievements whenever possible, such as “increased customer satisfaction by 15%.” Give specific examples of what you have done.

Keep it Concise

Keep your cover letter concise and to the point. Aim for one page, focusing on the most relevant information. Avoid unnecessary details or jargon. A well-written, concise cover letter is more effective than a lengthy one.

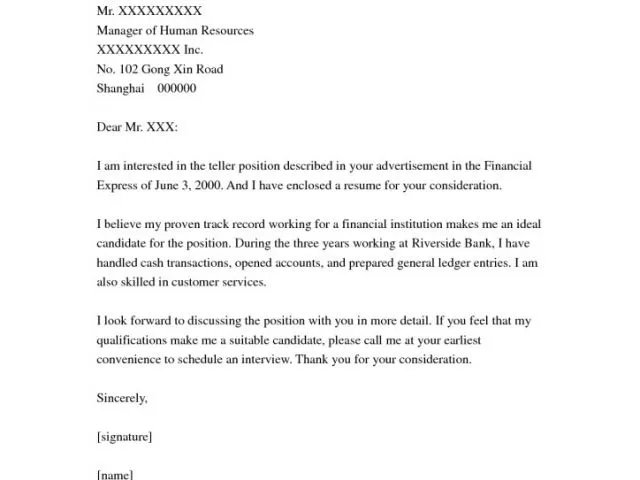

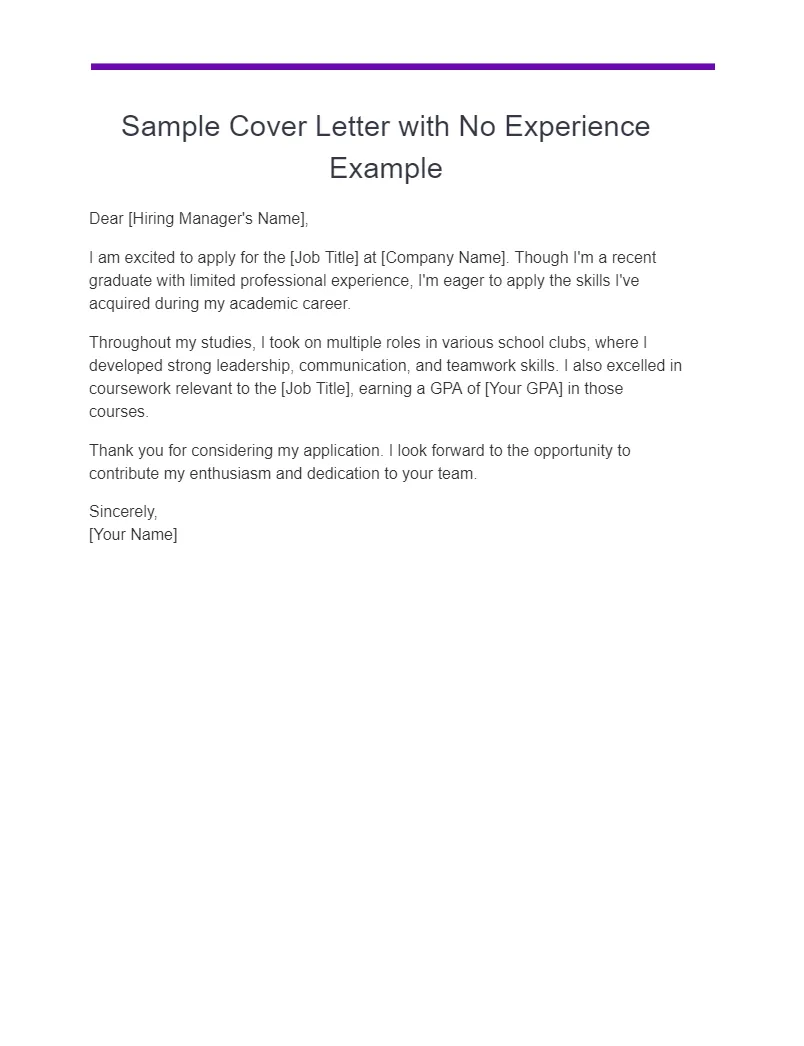

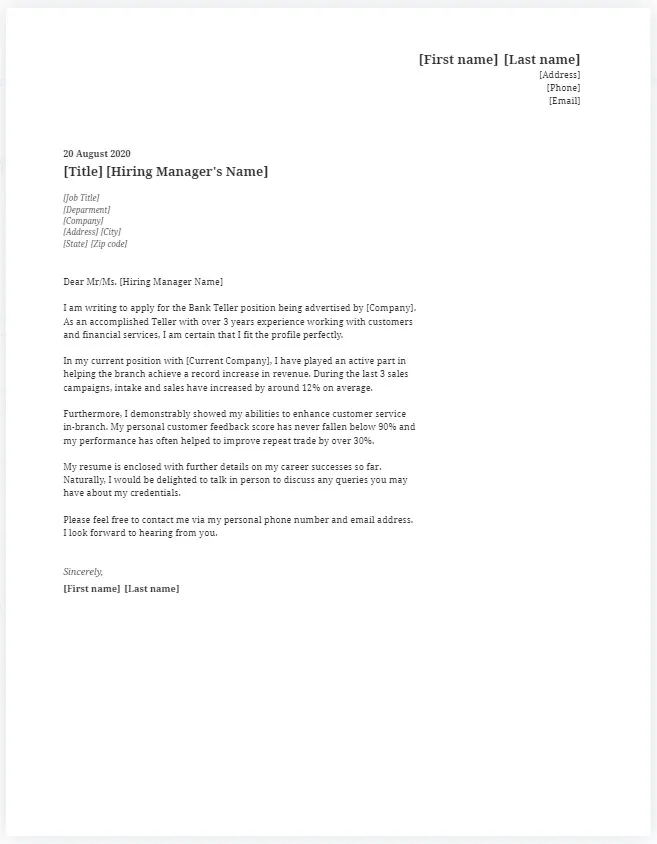

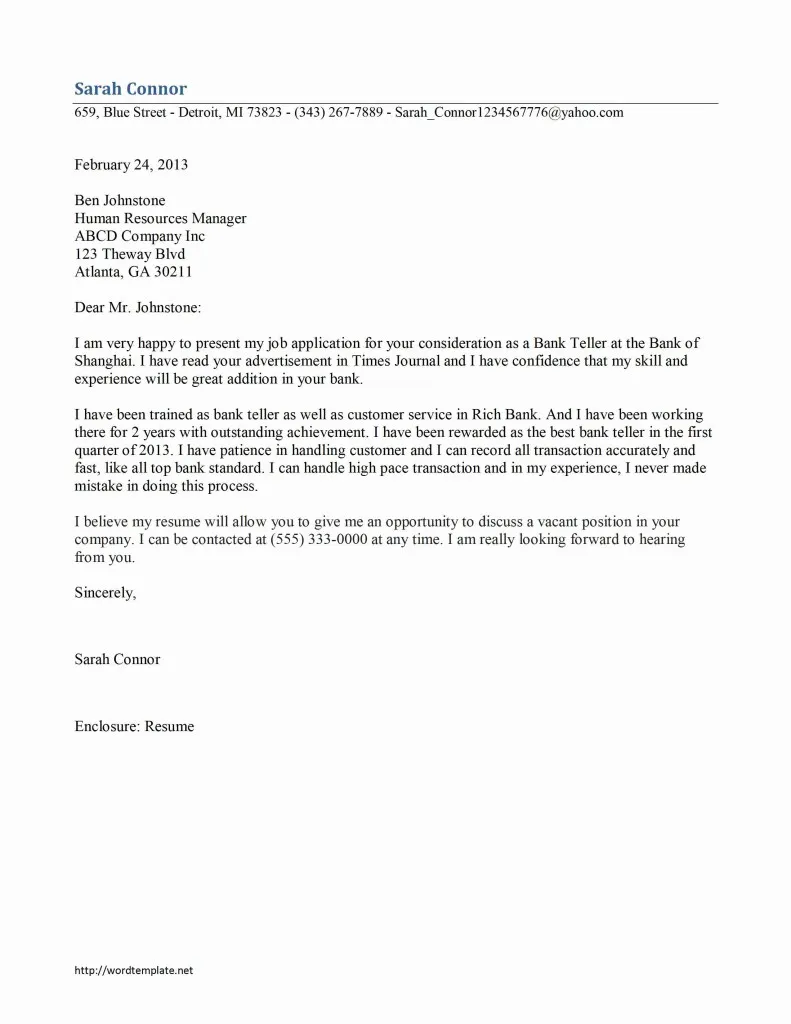

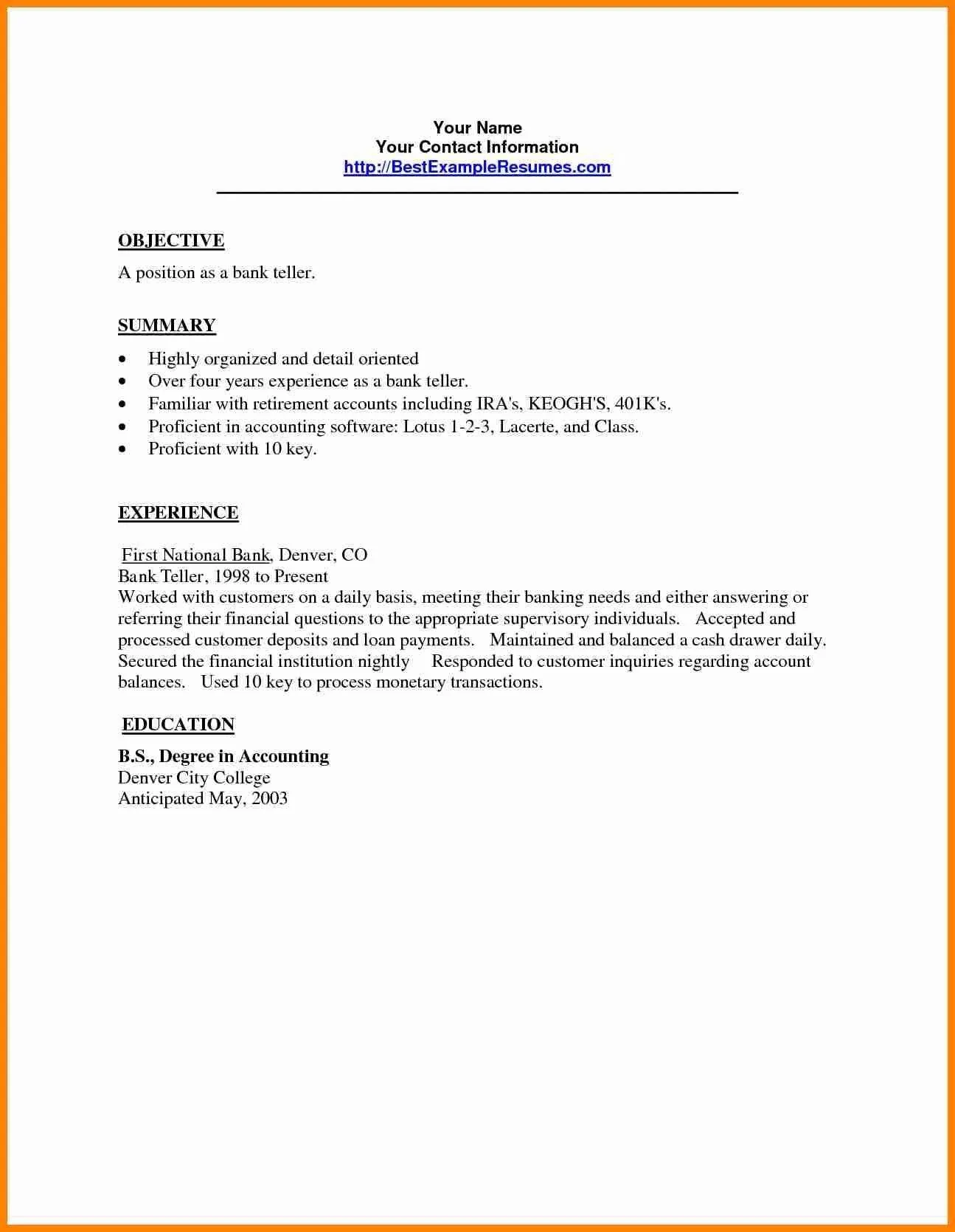

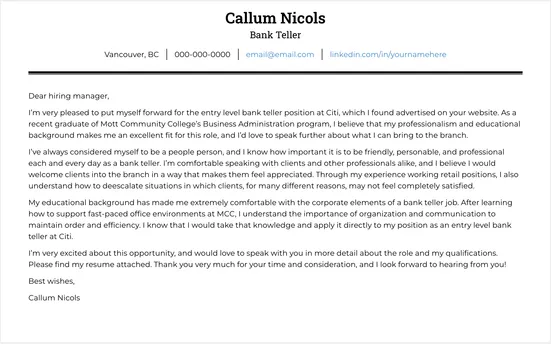

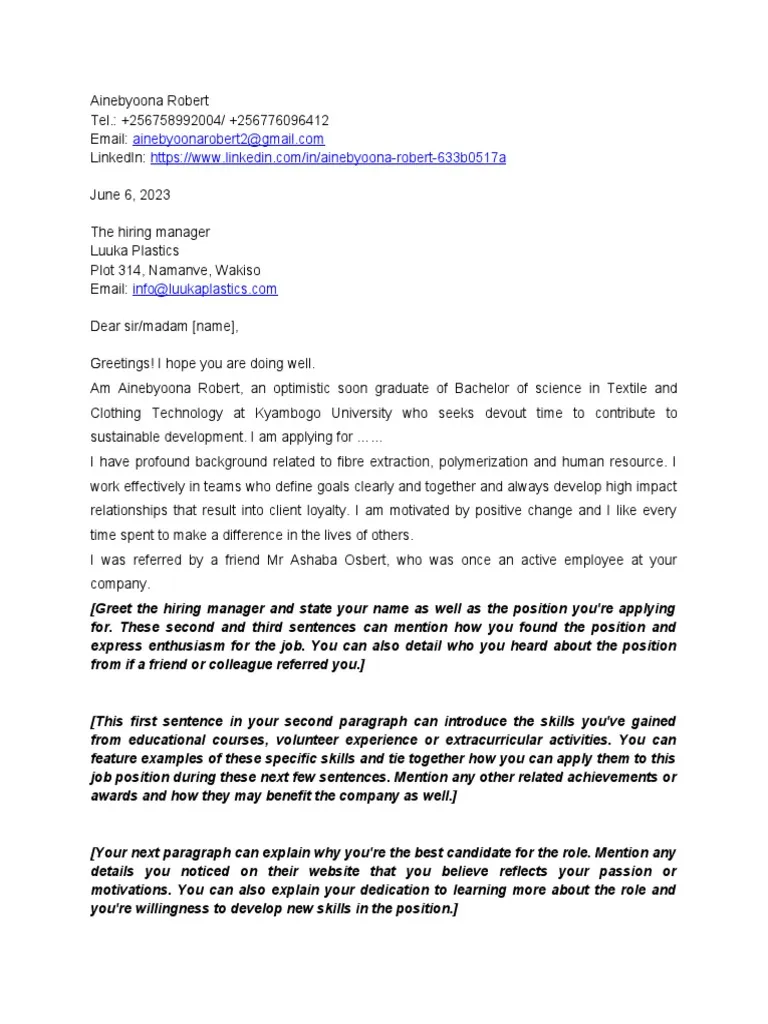

Cover Letter Example for Teller Position

Here is a sample cover letter to help get you started. Remember to tailor it to your own experiences and the specific requirements of the job. This example provides a template for you to follow. Adapt it to your own circumstances and qualifications.

Final Thoughts

Writing a cover letter for a teller position with no experience can be challenging, but it is definitely doable. Focus on your transferable skills, showcase your potential, and highlight your enthusiasm for the role. By following these guidelines and customizing your letter for each application, you can increase your chances of landing an interview and starting your career in banking. Use this guide as a starting point and customize it to create a cover letter that reflects your individual qualifications and aspirations.

Next Steps

Once you have written your cover letter, review it carefully to make sure it is perfect. Ensure that you have followed all of the key tips. Now, prepare for the interview and be ready to discuss your skills and experiences. Good luck with your job search.